The Department of Labor and Employment (DOLE) assured that workers’ wages be computed properly through its issued guidelines on pay rules for regular holidays and special non-working days for 2024.

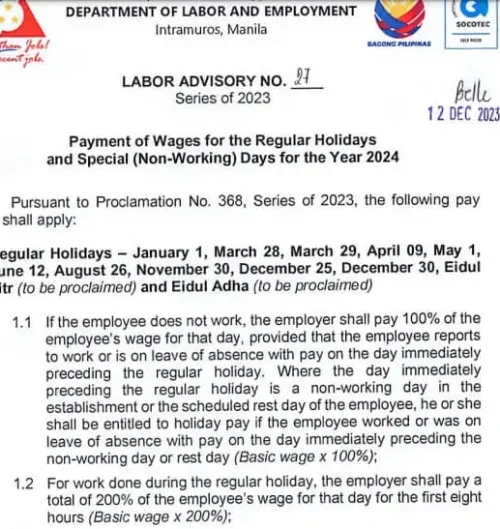

The guideline on pay rules is stipulated in Labor Advisory No. 27, Series of 2023 issued by Sec. Bienvenido E. Laguesma on Dec. 12, 2023 for employers and workers compliance for the proper payment of wages.

Moreover, the labor advisory is in accord with Proclamation No. 368, Series of 2023, declaring the regular holidays and special non-working days for 2024.

Pay Rules for Regular Holidays

Workers who render work during the regular holidays are entitled to 200% of their wage for the first 8 hours. If they do not render work, they shall be paid 100% of their wage for that day, provided they worked or were on leave of absence with pay on the day immediately preceding the regular holiday.

Moreover, when the day immediately preceding the regular holiday is a non-working day or a scheduled rest day for the workers, they shall also be entitled to holiday pay. Provided, they worked or were on leave of absence with pay on the day immediately preceding the non-working day or the rest day.

Pay Rules for Overtime Work During Regular Holidays

If workers render overtime work, they shall be paid an additional 30% of their hourly rate on that day. Thus,

(hourly rate of the basic wage) x (200%) x (130%) x (the number of hours worked)

Meanwhile, workers who render work on a regular holiday that also falls on their rest day shall be paid an additional 30% of their basic wage of 200%. In addition, workers who render overtime work shall be paid an additional 30% of their hourly rate on that day.

Pay Rules for Special NonWorking Days

The “no work, no pay” principle prevails unless there is a favorable company policy, practice, or collective bargaining agreement (CBA) that grants the payment on a special day.

If workers render work during a special non-working day, they shall be paid an additional 30% of their basic wage on the first 8 hours. On the other hand, workers who render overtime work shall be paid an additional 30% of their hourly rate on that day.

Meanwhile, workers who render work on a special day that also falls on their rest day shall be paid an additional 50% of their basic wage on the first 8 hours. Those who render overtime work shall be paid an additional 30% of their hourly rate on that day.

DOLE advises the public to call its hotline 1349 open 24/7 for further queries on the pay rules for regular holidays and special non-working days. The public may also call or send text messages to 0931-066-2573 open from Monday to Friday from 8 a.m. to 5 p.m. ▲

Source: Labor Advisory No. 27 – 23 Payment of Wages for the Regular Holidays and Special (Non-Working) Days for the Year 2024, DOLE

Since 2011, Regel Javines has been writing online, sharing news and analysis on a range of noteworthy and urgent social issues. He completed his bachelor’s degree in office administration at the Polytechnic University of the Philippines (PUP)—Taguig Campus, where he also served as editor-in-chief of the official school newspaper. See Regel’s published articles here.