The Department of Labor and Employment or DOLE urges employers to comply with holiday pay rules for workers on August 20, 21, and 27 holidays, according to the Labor Advisory No. 2 released on Aug. 16, 2012. While August 20 and 27 are regular holidays, August 21 is a special non-working day.

The following are proper computations of holiday pay according to DOLE under the Labor Advisory No. 2 s. 2012:

Holiday pay rules for regular holidays: August 20 and 27

1. If the employee did not render work during the regular holiday, he/she shall be entitled to 100 percent of his/her salary for that day. [(Daily Rate + COLA) x 100%]

2. If the employee reported for work on such day, he/she shall be entitled to 200 percent of his/her regular salary for that day for the first eight (8) hours. [(Daily Rate + COLA) x 200%]

3. For overtime work rendered during this regular holiday, he/she shall be entitled to an additional 30 percent of his/her hourly rate on said day. (Hourly Rate x 200% x 130% x Number of Hours Worked)

4. If the employee worked during a regular holiday that also falls on his/her rest day, he/she shall be entitled to an additional 30 percent of his/her daily rate of 200 percent. [(Daily Rate + COLA x 200%) + 30% (Daily Rate x 200%)]

5. For overtime work rendered during the regular holiday that falls on his/her rest day, he/she shall be entitled to an additional 30 percent of his/her hourly rate on said day. (Hourly Rate x 200% x 130% x 130% x Number of Hours Worked)

Holiday pay rules for special (nonworking): August 21

1. If the day is unworked, the “no work, no pay” principle shall apply, unless there is a favorable company policy, practice, or collective bargaining agreement (CBA) granting payment on a special day;

2. If worked, the employee shall be entitled to an additional 30 percent of his/her daily rate on the first eight hours of work. (Daily rate x 130%)

3. If the employee worked during a special day, he/she shall be entitled to an additional 30 percent of his/her hourly rate on such special day. (Hourly rate x 130% x Number of Hours Worked)

4. If the employee worked during the special day that also fell on his/her rest day, he/she shall be entitled to an additional 50 percent of his/her daily rate on the first eight (8) hours of work. (Daily Rate x 150%)

5. In excess of eight hours, he/she shall be entitled to an additional 30 percent of his/her hourly rate on such a special day. (Hourly Rate x 130% x 150% x Number of Hours Worked)

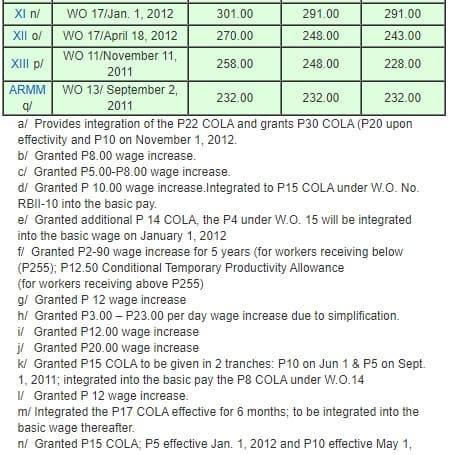

According to DOLE, the prevailing minimum wage (daily rate) in National Capital Region is Php446. Refer to the proceeding table for the summary of daily minimum wage rates in the country.

Summary of Current Regional Daily Minimum Wage Rates: Non-agriculture, Agriculture as of July 2012 (In pesos)

_________________________________

Sources:

NWPC updated July 30, 2012

DOLE

Since 2011, Regel Javines has been writing online, sharing news and analysis on a range of noteworthy and urgent social issues. He completed his bachelor’s degree in office administration at the Polytechnic University of the Philippines (PUP)—Taguig Campus, where he also served as editor-in-chief of the official school newspaper. See Regel’s published articles here.